#What is quickbooks desktop payroll how to

how to zero out accounts in quickbooks Like in QuickBooks Desktop, bank reconciliation for your business accounting in QuickBooks Online is a separate event.

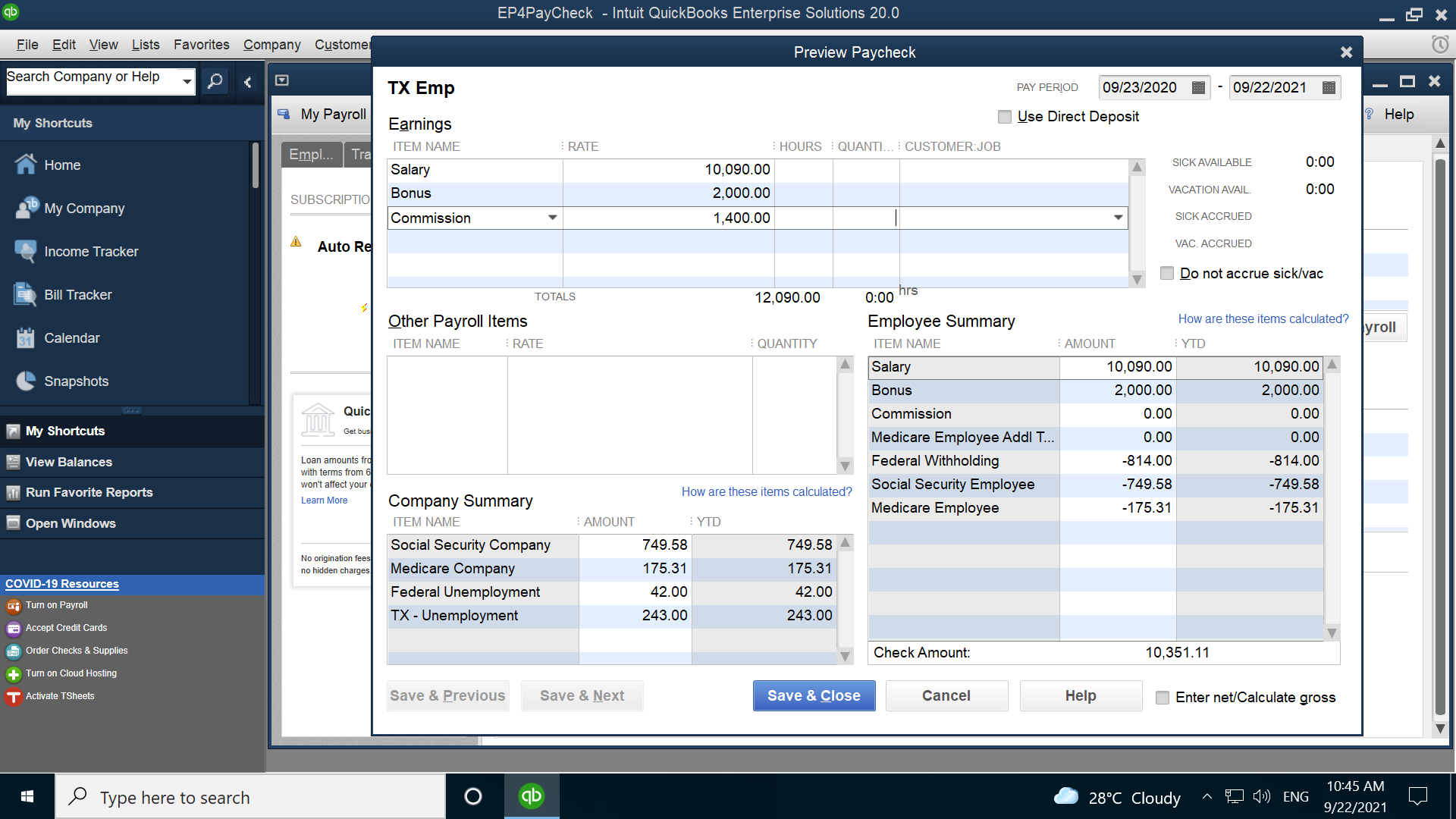

Setting up your journal entry and reconciling your payroll clearing account is a good way to stay on top of your largest expense and make paying payroll taxes seamless. How to Manually Edit QBO Payroll Liabilities. (In case you're reconciling for the very first time, select Get started to proceed.) Choose which account you want to reconcile first. Know How to Reconcile Payroll Liabilities in QuickBooks? Click on Payroll Taxes option and under Pay taxes, press Enter prior tax history. Payroll Clearing Account In Quickbooks and Similar. You'll need to fill in the beginning balance, ending balance and statement end date to reconcile QuickBooks online. Select the bank account from which you made the sales tax payment from the Account drop-down list. Click on Payroll Taxes option and under Pay taxes, press Enter prior tax history. If the business is sold along with assets. In the QuickBooks Online Navigation bar, select Taxes. Join Pat Hartley, small business consultant in Southern California, as she shows you how to adjust the payroll tax liabilities so your accounting and payroll. When you are ready to get moving, Select the gear in the top right of the QuickBooks Online menu. If you want to print your old reconciliation reports in quickbooks, then you are in right place. How do I enter employee information into QuickBooks? How to Zero out Payroll Liabilities in QuickBooks? Payroll reconciliation sounds daunting, and it's yet another thing on your plate as a small business owner. Step 1: Run a payroll register for the quarter. Payroll liabilities also include other amounts you track on paychecks including: 401(k.

Just because you have entered transactions into QBO using forms, the bank feed, or some third-party data fetching app, you still.

#What is quickbooks desktop payroll manual

Answer: Step 1: Create manual tracking accounts If you haven't already, follow the steps to create new accounts in your Chart of Accounts to track your payroll liabilities and expenses. For cleaning up payroll liabilities in QuickBooks you need to remove or delete a scheduled payroll liability.

0 kommentar(er)

0 kommentar(er)